Trusted by

Cegid’s promise

Why choose Cegid Exabanque?

Live the Cegid Exabanque experience

Are you looking for a solution that will help you manage your cash flow and guarantee the security of your transactions? Cegid Exabanque has been supporting over 3,000 companies for 25 years.

More informationBanking communication

Cash management

Banking reconciliation

Flow automation

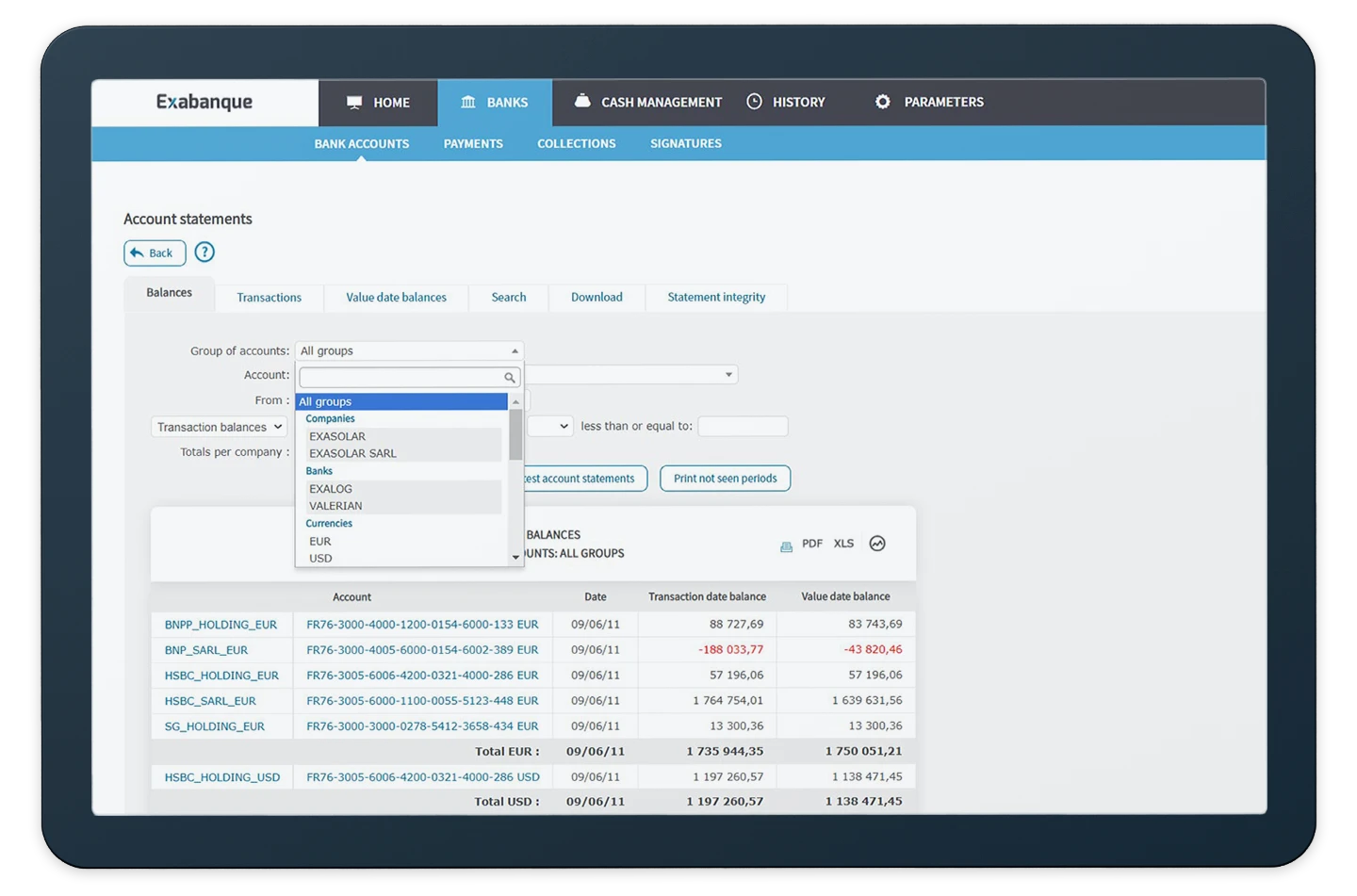

Banking communication

File exchange using EBICS or FTP protocols

Ensure the compliance and security of your banking transactions: detailed follow-up of account statements, control and digital signature of orders, creation of SEPA payment and direct debit files.

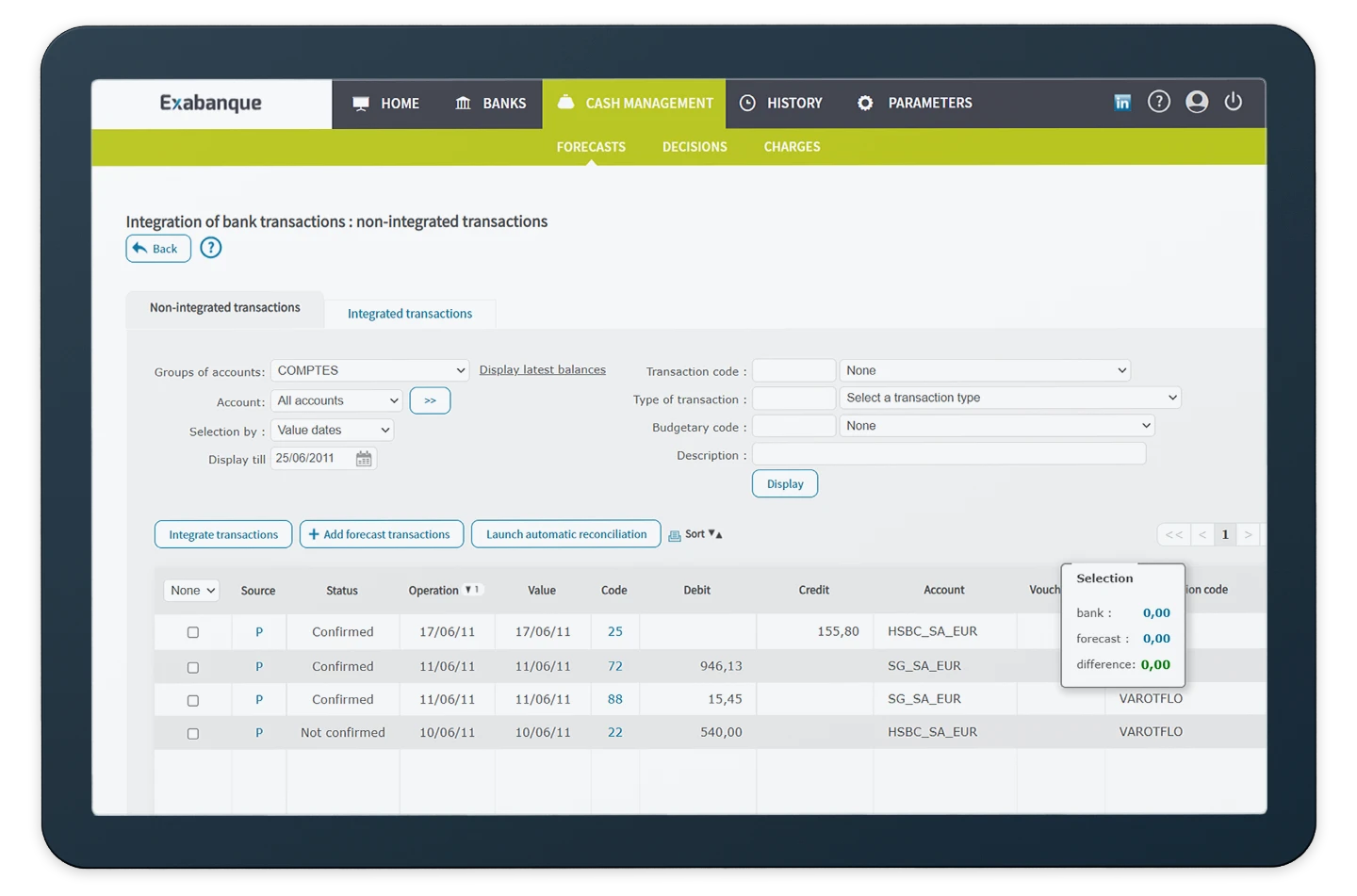

More informationCash management

Optimized cash management

Facilitate the day-to-day management of your financial resources and ensure better strategic decision-making: forecast management, investments and financing, analytical follow-up of cash flows, automation of frequent requests.

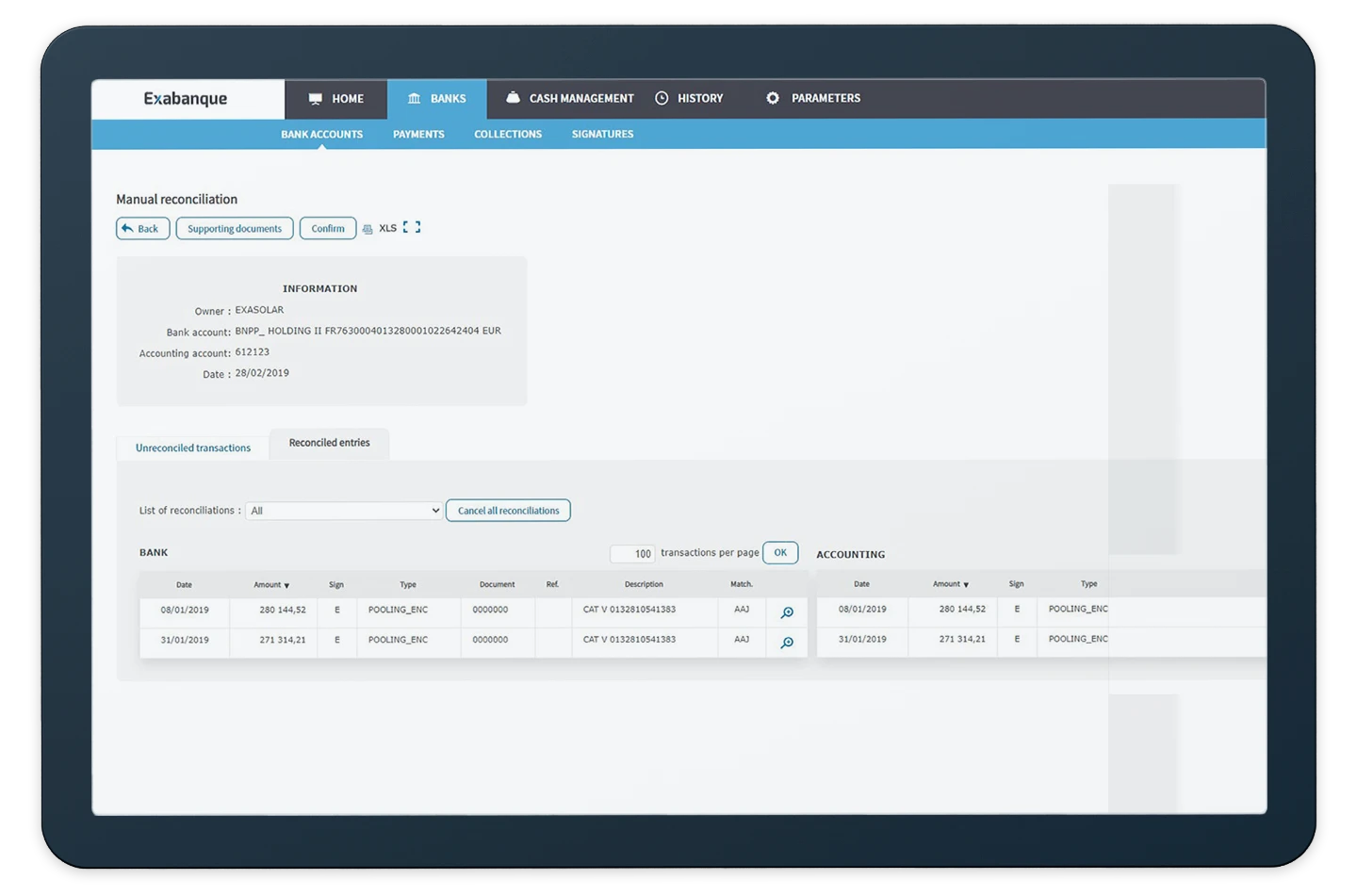

More informationBanking reconciliation

Reliable and simplified accounting

Ensure accurate accounting management: automated bank entry lettering, automatic reconciliation rules, reliable accounting work.

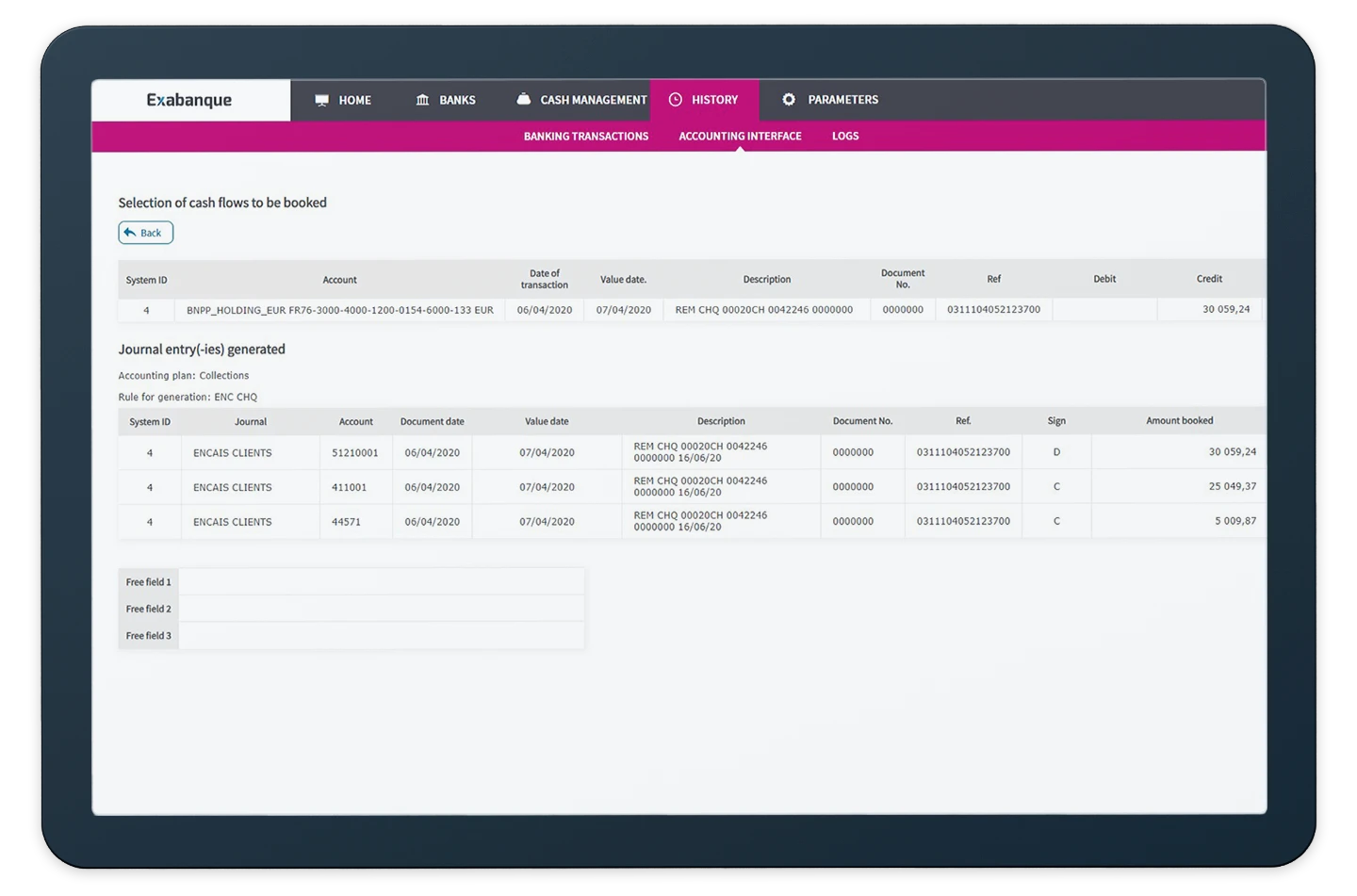

More informationFlow automation

Optimized and automated flows

Optimize your financial processes: ERP interface for synchronizing ERP with Cegid Exabanque, accounting interface for automatic generation of accounting entries.

More informationCegid Exabanque subscription features

Optional services:

Discover all the features of Cegid Exabanque

Cegid Exabanque

Web-based multi-banking and cash management software for SMEs

Solution for managing payments and collections, cash flow and accounting reconciliation. It is aimed at all companies within SEPA

More information Free trialLet Cegid guide you

Explore our expert advice to bring out the full value of your business.

Enjoy articles, practical guides, videos, and free document templates.

Access resourcesComplete your Cegid Exabanque solution

Cegid Allmybanks

Cegid Allmybanks secures financial flows and optimizes cash flow for groups and SMEs

- SWIFT, EBICS and FTP banking communication

- Group cash management

- Advanced reporting and analysis tools

- Complete security and traceability

Cegid Direct-debits

Cegid Direct-debits simplifies the management of SEPA direct debits and mandates

- Administration of payment schedules

- Creation and storage of mandates

- Automatic generation of direct debit orders

- Handling of overdue payments