Retail & Distribution

Asian retail rides the crisis to emerge stronger than ever

16 November 2021

Despite 61.76% of retailers reporting in Inside Retail’s Asian Retail Outlook review that 2020 had been anywhere from poor to the worst they had experienced, most had responded with a burst of creativity and innovation. They raised the bar when it came to customer engagement, digital, delivery and even bricks-and-mortar retail, despite the impact of multiple factors, chiefly the Covid-19 pandemic, consumer confidence, travel and supply chain disruptions.

And all this took place in the context of consumers’ expectations and behaviours changing dramatically, in terms of brand choices, online fulfilment options, delivery speed and omnichannel (the way consumers now shop seamlessly across channels). And not just established channels but emerging ones that are influencing sales including purchases from social channel referrals that skyrocketed by 104% in 2020 [1].

Channel hopping is now everyday retail

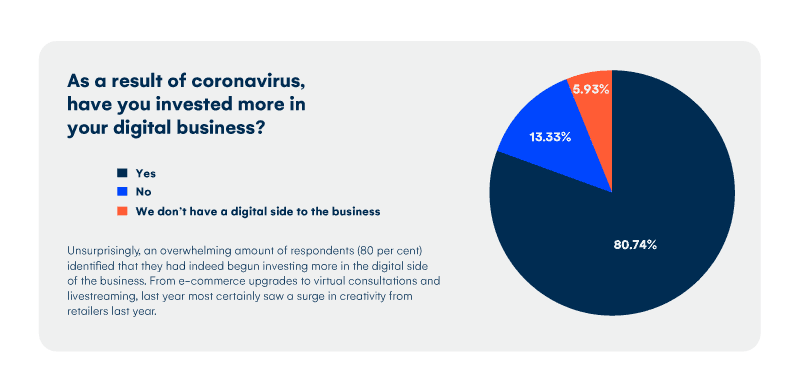

How shoppers buy has also changed and will continue to change. Customers’ expectations around online delivery, speed of fulfilment, service and omnichannel experiences have all risen sharply, which is putting pressure on stores to take a leading role within a multi-channel retail shopping ecosystem. Investment has already followed this logic; according to the Asian Retail Outlook study, over 80% of respondents had invested more in their digital business.

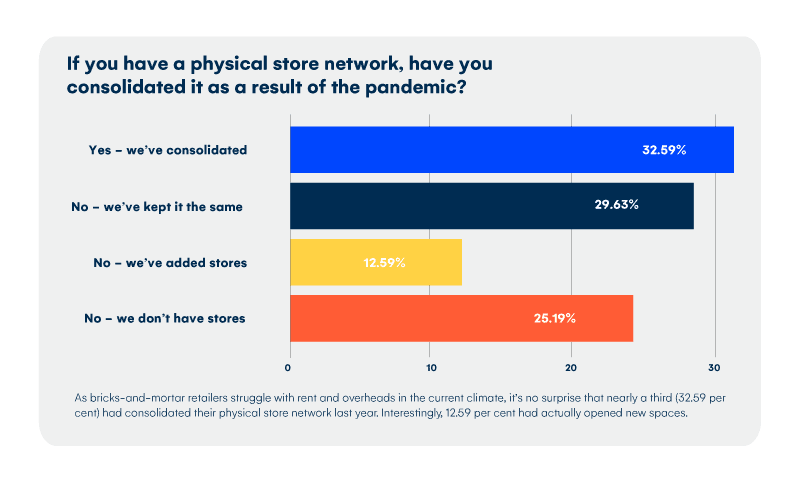

In Asia, the real clue to the future that is already emerging was how retailers coped in the first year of the global health crisis. The shift to ecommerce was significant for 70.5% of respondents. However, it is important to note that it still accounts for not much more than 10% of revenue, and stores remain the primary source of sales. Even as a result of the pandemic, while 32.59% of retailers consolidated their store network, 42.22% had either kept the same number of stores or opened new ones.

What they expect from those stores and malls however has expanded significantly. The store operates in a world in which customer journeys effortlessly and seamlessly cross channel boundaries. By embracing both new and emerging digital channels, the store becomes an experience, service and fulfilment hub for every kind of shopping journey, personalised to the preferences of each customer.

Products, values and convenience go hand in hand

Asia has pioneered much of the new thinking about retail, due in part to its very different demographics. Gen Z (born after 1997) have a huge influence on the commercial landscape in China given that are more than 300 million of them. They want convenience of course but they also want to buy brands that align with their values and that they feel an affinity with. In the digital retail survey, 82 percent of consumers in mainland China’s nine mega cities agreed that they “like to use brands that share my social values.”

82% of consumers

in mainland China’s nine mega cities agreed that they “like to use brands that share my social values.

Sustainability for instance is an issue in two respects – retailers want to demonstrate their environmental commitment and also cut costs where they can, while customers increasingly demand it as part of their reason to shop from a particular brand. Japanese department store, Takashimaya, for instance, is digitising paper, using more sustainable building materials, using alternative energy sources, and stocking more sustainable brands.

Data enables personalisation

These consumers also want experiences personalised to them. Key to this is retailers being able to access data through in-store devices, whether hand-held, fixed terminals or woven into the structure of the store. Data can then be consolidated and analysed continuously, often in real-time, to enable store staff to personalise the customer experience.

The Asian Retail Outlook 2021 pointed that consumers more than just personalised experiences. More than 67% said that a connected customer journey with context was key to winning their business. And this is not just about face-to-face, but being able to continue the conversation online through owned as well as digital channels. This ability is central to customers’ expectations on how they connect to brands. WeChat for instance is a self-contained social and commerce ecosystem within which consumers can manage their social and retail life.

But with big data comes big responsibility. Consumers across Asia expect to be safeguarded in two main ways – physically, through the provision of hygiene, way signing, social distancing and people management, and digitally, in terms of how their data is stored, used and shared. Right now, consumers are worried about how their data is collected and used; a survey of 75,000 consumers in China by KPMG in 2020 found that 44% of consumers in the mainland GBA cities and 59% of consumers in Hong Kong feel that the level of data privacy maintained by retailers is only ‘moderate.’

75,000 consumers in China

from a survey by KPMG in 2020 found that 44% of consumers in the mainland GBA cities and 59% of consumers in Hong Kong feel that the level of data privacy maintained by retailers is only ‘moderate.’

The store needs friends everywhere

All these dynamics are affecting the operation and function of the store and it is clear that it cannot go it alone. The gaps between store and online are being bridged, to recognise the extent to which consumers are shopping across channels, and the growth in popularity of those channels. By offering both physical and digital, owned and partner channels, retailers and brands can be unlimited in their reach, embracing social, marketplaces and affiliates, particularly where those platforms are growing so fast, including Amazon and Alibaba.

Partnerships also include technology companies able to provide distribution and payment front ends for brands trading across borders, particularly into the fast growth economies of Indonesia, the Philippines and Singapore. These partnerships in Asia are of particular interest to brands that in many cases are bypassing traditional retail channels to reach new markets quickly and at scale.

And these partnerships may be as much about customer-facing as well as back-office technology. Robots for instance, may not look like they have much to do with customer experience but at Mr DIY it is one of the main reasons they decided to invest in warehouse automation. The warehouse can now carry 23% more stock and offer more to customers when those products are not in store. It can also pick and pack quicker to keep pace with customers’ demand for fast delivery.

[1] Source: Salesforce Report

Asian Retail Outlook 2021

How brands are adapting to digital in the ‘new normal’? Discover what the new customer experience looks like in the current climate in Asia

Download the report