Together,

make more possible

Say yes to your projects and grow your business with Cegid’s purposeful and innovative solutions.

See our solutions ⇣EBP Shareholders Enter into Exclusive Negotiations with Cegid to Create a European Leader in the Highly Strategic and Growing Market for Micro and SMB Enterprise Software.

Inspired by your business, ready for you

Retail & Distribution

Elevate Your Retail Experience.

Deliver an exceptional customer experience across all channels, all over the world, thanks to engaged in-store teams who are ambassadors of your brand.

Human Resources

Rethink work experience for lasting performance.

Drive and manage the transformation of your organization, simplify HR processes and accelerate HRIS productivity with a global and open HCM platform.

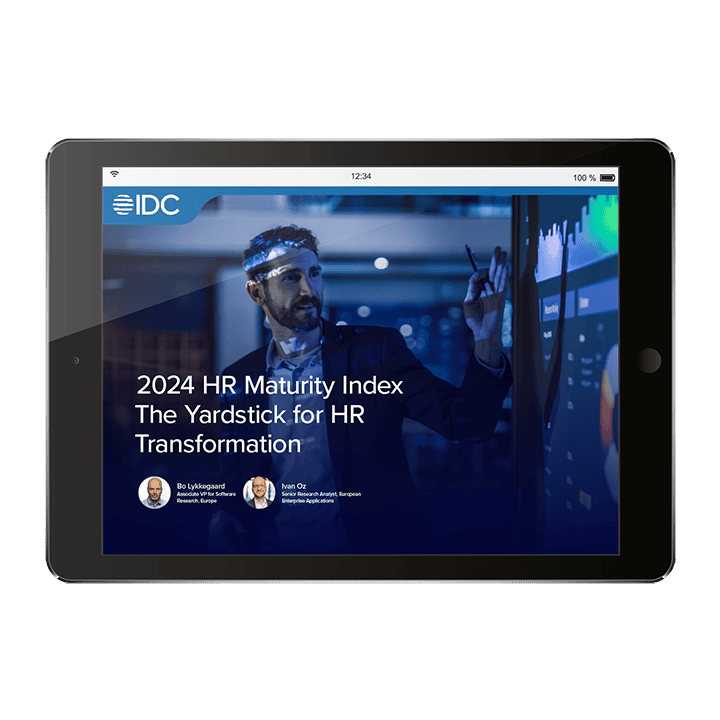

Expert insight and resources to benefit your business

Unlocking Success: Cegid’s Dubai PoD Revolutionises Retail in the Middle East

Article 23 april 2024 2 min

Multi-sites recruitment : How to ensure effective collaboration ?

Ebook 25 maart 2024

The Recruitment Game-Changer: A 12-Step Guide to an Exceptional Candidate Experience

Ebook 7 maart 2024

Purposeful innovation with the sole objective of creating value for our customers

User experience

We optimize the user experience, with the aim of making it even more intuitive.

find out more

Artificial Intelligence

We integrate augmented intelligence into our products, allowing our customers to anticipate and make informed decisions using scenario modeling.

Learn More

Automation

We automate repetitive tasks so that our customers and their teams can focus on missions with a high added value for their businesses.