Retail & Distribution

Looking to upgrade your Order Management System? Be sure to ask these 7 questions

30 september 2019

The majority of growth will be in SaaS implementations which are expected to grow an incredible 182% during the period says IHL. This is confirmation that innovative retailers are striving to adopt a fully unified commerce IT strategy, getting themselves fit for the future of retail.

Exploring the fast-growing and complex OMS market, IHL has issued an in-depth analyst report: Order Management Market Guide 2019. For any retailer looking to deploy OMS, this report details what they need to know about vendors and solutions. It’s a valuable tool for those retail professionals considering the challenges and opportunities in the current OMS market.

The report’s objective is to help the retailers fully understand the market. It provides high-quality advice from technology analysts on the best vendors and software offerings currently on the market. It will help retailers to choose the right vendor for them, selecting from what can be quite a complex global vendor landscape.

OMS is the core system for unified commerce

The IHL report states: “OMS has quickly become THE CORE system that allows for Unified Commerce to be successful.” Retailers looking to select a new OMS are urged to begin by asking key questions:

- Can we opt for a SaaS solution ? Benefits from a SaaS-based OMS platform are many, which is why the vast majority of retailers aspire to this cost model. There is a much lower Total Cost of Ownership with SaaS, when considering the capital, operational and incidental costs of running a powerful order management system. Purchase and licensing models are available but the trend is for SaaS confirms IHL.

- What is the vendor’s roadmap for Artificial Intelligence (AI) and Machine Learning (ML) ? What functionality is coming if not available today from vendors being considered for OMS? Is it customised or embedded? Whose APIs is it based upon? IHL is very bullish on AI and believes some of the greatest ROI wins are around those solution components utilising AI and ML.

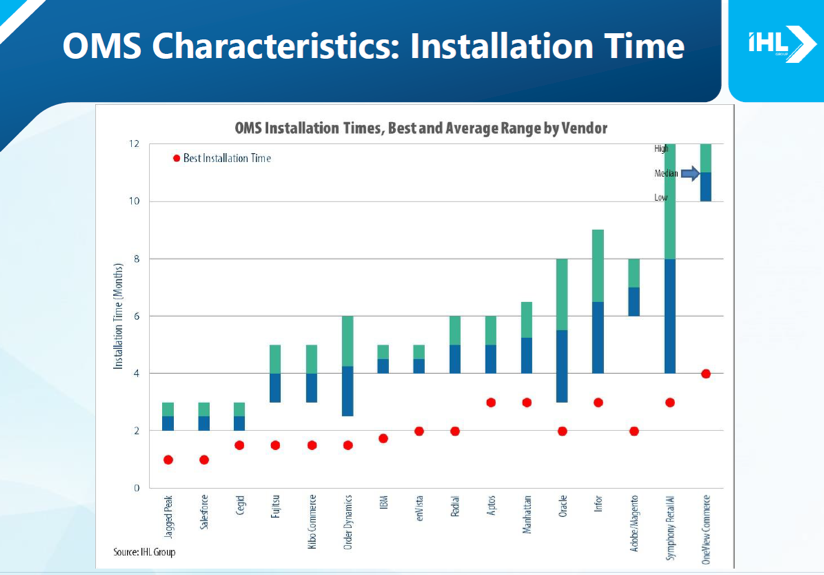

- How long will it take to install and begin benefiting from the OMS software being considered ? The IHL report compares speed to install among vendors and notes the vendors with the quickest installation times. For many retailers speed of implementation is vital to begin generating return on investment from a new OMS as swiftly as possible.

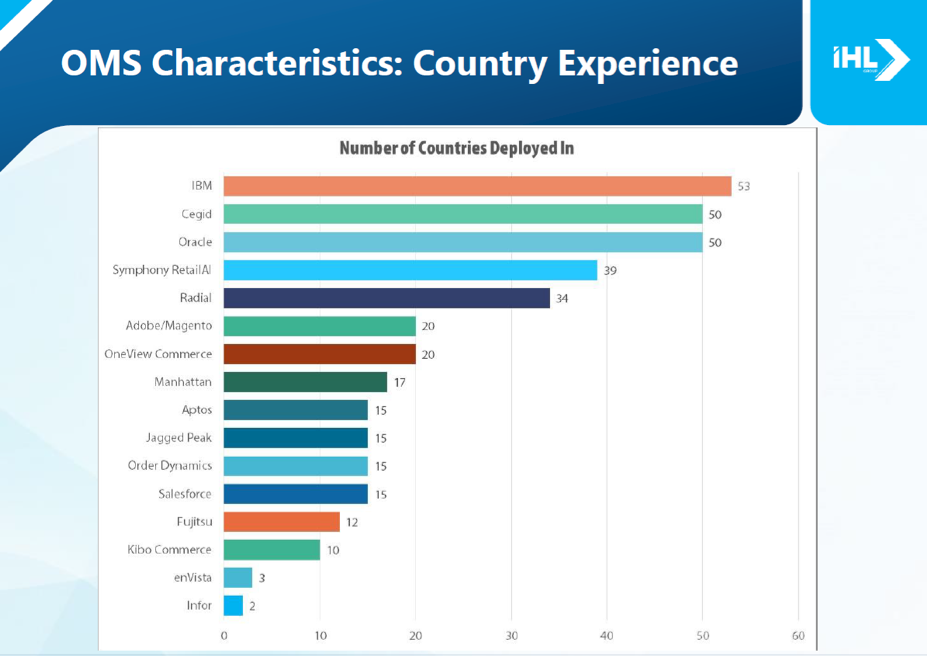

- Does the OMS vendor being considered have international reach and experience of installations all over the world ? This is vital in today’s global market where many retail brands are represented across a large number of international locations. Vendor expertise on the ground across territories can ensure compliance issues and local challenges are quickly and efficiently overcome, saving the retailer time and expense.

- How many customer journeys does the OMS software support ? It’s very important in today’s omnichannel world for retailers to be able to cater for countless customer journey needs. So, when investing in a new OMS they should ensure that capabilities such as BOPIS, BORIS, Endless Aisle and Click & Collect are fully supported.

- Which integrations are off-the-shelf versus custom-built ? Depending on a retailer’s roadmap and current solutions, it’s important to explore the trade-offs between using the same versus multi providers of POS and ecommerce software. Many of the vendors summarised in the report offer broad suites supporting many of the Unified Commerce pillars.

- What about GDPR and other data protection regulations ? Naturally retailers want to know that the information collected by their OMS can be GDPR complaint, and in line with other data protection requirements. Retailers must check with the OMS vendor how their software processes and stores customer data, and how at installation existing customer data is securely transferred and managed.

Cegid acknowledged as a world-class OMS player

IHL has recognised Cegid in its latest Order Management Market Guide 2019, citing the ability to process 102 different customer journey scenarios, for its SaaS proposition, and for its impressive track record of successful retailer installations. The report notes that Cegid has “one of the quickest installation times” and describes Cegid as “a leader” in this respect, having a global OMS footprint, with installations in over 50 countries worldwide.

The vendors landscape in terms of installation time according to the IHL Study.

The vendors landscape in terms of worldwide footprint according to the IHL Study

Cegid can also meet retailers’ needs with a new DOM (Distributed Order Management) solution to optimise inventory management and stock locations. The Cegid Retail DOM offers a single repository combining different sales channels, a real-time view of inventory management in-store and across all channels. This provides a single control drive of all operations and flow management. Once again, retailers can focus on ensuring their customers’ purchases and fulfilment choices are available, meaning sales are never missed.

Read for yourself how OMS vendors are working hard to meet the needs of retailers in a fast-changing omnichannel retail landscape.